Box office results for 20101

Strategic objective

Greater number of Canadians enjoy distinctive Canadian films

Key performance indicator

Market share of Canadian box office revenue

Target

5%

2008-2009 results

2.9%

2009-2010 results

3.3%

2010-2011 results

Canadian titles captured 3.1% of the overall domestic box office.

Box office results

This past year capped a remarkable ten years of impressive box office results for Canadian films, achieving an overall growth of 134%, which was six times higher than that of the overall market.

Telefilm's contribution went further; an increased participation by the private sector and international partners allowed for more projects to be supported with less investment.

Led by the Oscar-nominated films Incendies and Barney's Version, Telefilm-supported projects won 127 awards around the world.

Top 10 Canadian films in Canada

| Title | Box office 2010 ($M) | ||

| French-language | English-language | Total | |

| Resident Evil: Afterlife | 1.1 | 5.8 | 6.9 |

| Piché : Entre ciel et terre | 3.6 | 0.0 | 3.6 |

| Incendies* | 2.5 | 0.2 | 2.7 |

| Lance et compte | 2.3 | 0.0 | 2.3 |

| Splice | 0.3 | 1.9 | 2.2 |

| Filière 13 | 1.9 | 0.0 | 1.9 |

| Imaginarium of Dr. Parnassus | 0.1 | 1.0 | 1.1 |

| Les sept jours du talion | 1.1 | 0.0 | 1.1 |

| Le journal d'Aurélie Laflamme | 1.1 | 0.0 | 1.1 |

| L'enfant prodige | 0.8 | 0.0 | 0.8 |

| *Film still in theatres at December 31, 2010 | |||

By linguistic market

Total gross box office surpassed $1 billion for the second year in a row, and grew almost 3% from 2009 to 2010. However, the total gross box office for Canadian films dipped almost 4%.

Total gross box office

| 2009 | 2010 | Difference | |

| ($M) | |||

| French-language market | 144.7 | 150.1 | 3.8% |

| English-language market | 862.2 | 886.0 | 2.8% |

| Total Market | 1,006.9 | 1,036.1 | 2.9% |

| Source: MPTAC, figures are rounded. | |||

In the independent film market2, Canadian films in the English-language market are an exception with an increase of $5.3 million in box-office earnings in one year, a 78% increase. Foreign films in English saw a decrease of $19 million. In the French-language independent film market, Canadian films experienced a decrease of $6.6 million or close to 25% while foreign films retreated by $1.6 million or almost 8%.

Gross box office – independent films

| 2009 | 2010 | Difference | |

| ($M) | |||

| Canadian Films | 26.7 | 20.1 | -24.7% |

| Foreign films | 21.6 | 20.0 | -7.6% |

| French-language market | 48.3 | 40.1 | -17.1% |

| Canadian Films | 6.8 | 12.1 | 77.8% |

| Foreign films | 130.2 | 111.2 | -14.6% |

| English-language market | 137.0 | 123.3 | -10.0% |

| Canadian Films | 33.6 | 32.3 | -3.9% |

| Foreign films | 151.8 | 131.2 | -13.6% |

| Total market | 185.3 | 163.4 | -11.8% |

| Source: MPTAC, figures are rounded. | |||

Box office analysis of Canadian films

Box office trend over ten years

| 2001 | 2010 | Difference | |

| ($M) | |||

| All films | 855.0 | 1,036.1 | 21.2% |

| Independent market | 133.6 | 163.4 | 22.3% |

| Canadian films | 13.8 | 32.3 | 134.1% |

| Source: MPTAC, figures are rounded and box office is measured in current dollars. | |||

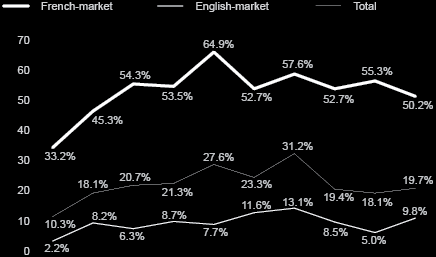

A look back over ten years of box office results provides an interesting perspective. Total box office has grown by 21.2% while independent film box office has increased about the same. However, Canadian film box office has surpassed both these categories with explosive growth of 134% – over six times higher than the overall market.

Total gross box office for Canadian films was down by 3.9% in 2010 compared to 2009; one interesting statistic is the change in box office results by language. French-language box office dropped almost 25% while English-language box office rose over 75%.

This statistic illustrates the huge impact that one extremely successful film can have on annual box office results. In 2009, De père en flic powered the French-language market with a $10.7M box office, while the highest-grossing French-language film of 2010 was Piché : Entre ciel et terre at $3.6M. The English-language market had the opposite experience. In 2010, Resident Evil: Afterlife grossed $6.9M while the highest take of 2009 was $3.0M for Trailer Park Boys: Countdown to Liquor Day. Considering both languages, the top four Canadian films earned almost half of the box office for all Canadian films in 2010.

Market share

Market share of Independent Film

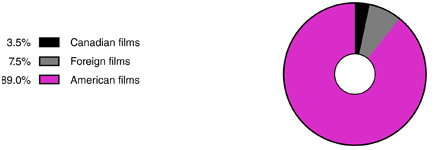

Again in 2010, American films dominated the market with an astounding 92.9% share. Total market share for Canadian films has hovered around 3% for each of the past four years.

| 2010 Market share | French-language | English-language | Total |

| Canadian films | 13.4% | 1.4% | 3.1% |

| Foreign films | 6.7% | 3.5% | 4.0% |

| U.S. films | 79.9% | 95.1% | 92.9% |

| Total | 100.0% | 100.0% | 100.0% |

| Source: MPTAC | |||

Within the independent film market, Canadian films can and do compete with a more robust 20% share.

| Independent film market | French-language | English-language | Total |

| Canadian films | 50.2% | 9.8% | 19.7% |

| Foreign films | 23.4% | 20.8% | 21.5% |

| U.S. films | 26.4% | 69.3% | 58.8% |

| Total | 100.0% | 100.0% | 100.0% |

| Source: MPTAC, figures are rounded. | |||

In fact, Canadian films in the French-language segment dominate the independent film market with a 50% share. Even in the English-language segment, Canadian films increased their market share substantially year-over-year – from 5.0% in 2009 to almost 10% in 2010.

Independent box office in 2010

In the independent market, Canada managed to place two films in the top 10 grossing films for 2010, compared to only one in 2009.

Top 10 Independent films in Canada

| Title | Box office 2010 ($M) | ||

| French-language | English-language | Total | |

| Grown Ups | 1.5 | 14.0 | 15.5 |

| The Expendables | 1.7 | 11.6 | 13.3 |

| Dear John | 1.0 | 6.6 | 7.6 |

| Resident Evil: Afterlife | 1.1 | 5.8 | 6.9 |

| Cats and Dogs: The Revenge of Kitty Galore | 0.9 | 3.8 | 4.8 |

| The Switch | 0.2 | 3.8 | 4.0 |

| The American | 0.3 | 3.6 | 3.9 |

| Vampires Suck | 0.9 | 2.8 | 3.7 |

| Piché : Entre ciel et terre | 3.6 | 0.0 | 3.6 |

| The Last Exorcism | 0.5 | 2.9 | 3.4 |

| Source: MPTAC, figures are rounded. | |||

Number of films released

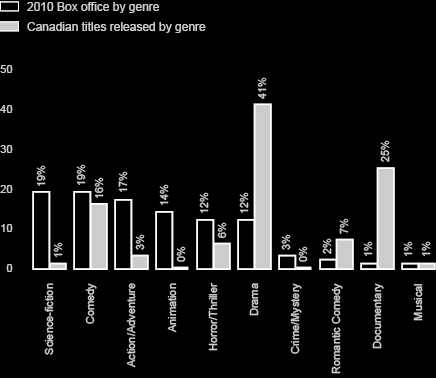

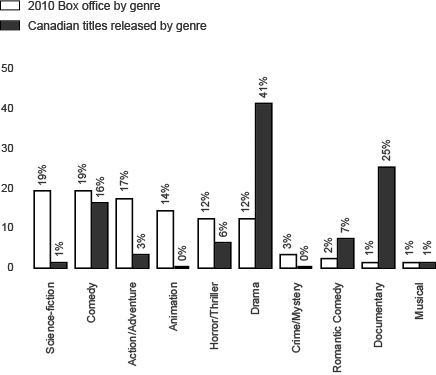

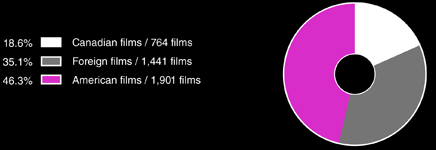

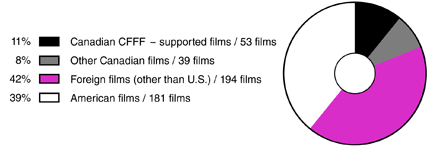

Breakdown of new titles released in 2010

Source: MPTAC

Source: MPTACBy number, Canadian films represented close to 20% of 467 new titles released in Canadian commercial theatres in 2010, and occupied 5.5% of Canadian screens.

Out of 92 Canadian films released in 2010, the CFFF contributed financial production support to 53. CFFF-supported films released in 2010 accounted for 71% of total Canadian box office.

53 Canadian films funded by the CFFF

|

10½ 2 fois une femme A l'origine d'un cri A Shine of Rainbows Altitude Barney's Version Cabotins Control Alt Delete Cooking with Stella Curling Defendor Everywhere Faith, Fraud, and Minimum Wage Filière 13 Force of Nature: The David Suzuki Movie Fubar 2 Gravytrain Grown Up Movie Star Gunless High Life Hugh Hefner: Playboy, Activist and Rebel Incendies Krach La dernière fugue Lance et compte L'appât |

Le baiser du barbu Le journal d'Aurélie Laflamme Le poil de la bête L'enfant prodige Les sept jours du talion Leslie, My Name is Evil Mesrine : l'instinct de mort Mr. Nobody Oscar et la dame rose Pax Americana Piché : Entre ciel et terre Reel Injun Reste avec moi Romaine par moins 30 Route 132 Score: A Hockey Musical Simon Konianski Sortie 67 Splice The Coca-Cola Case The Trotsky The Wild Hunt This Movie is Broken Trigger Trois temps après la mort d'Anna Tromper le silence Year of the Carnivore |