Responsible administrator

Strategic objective

Client services

Key performance indicator

Client satisfaction

Target

Maintain or increase client satisfaction level compared to most recent Canada-wide survey

2008-2009 results

Canada-wide survey was postponed to 2009-2010

Canada Media Fund Program Administrator (CMFPA) survey rates satisfaction at 7.9 out of 10

2009-2010 results

Canada-wide survey reported an increase in overall satisfaction scores compared to 2005-2006

2010-2011 results

Executive Director held cross-country consultations preceding new corporate plan

Program delivery adopted a more streamlined approach to simplify processes, improve client service and quality control

Strategic objective

Transparency and accountability

Key performance indicator

Refine established performance indicators

Target

Optimize operational efficiency by monitoring financial and operational indicators

2008-2009 results

Financial indicators have been met

Operational indicators for project funding decisions have been reviewed

2009-2010 results

Most of the operational and financial indicators have been met

2010-2011 results

Most of the operational indicators have been met

Financial targets have been met

Strategic objective

Efficient administrator

Key performance indicator

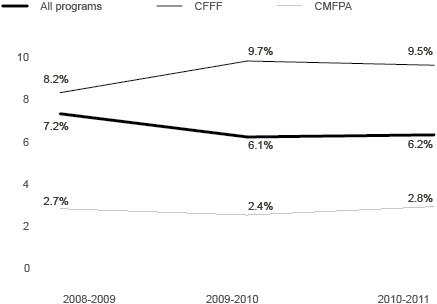

Management Expense Ratio (MER)

Target

Maintain a low MER:

• All programs, including Canada Media Fund (CMF) programs

• Canada Feature Film Fund (CFFF)

• Canada Media Fund Program Administrator (CMFPA)

2008-2009 results

7.2%

8.2%

2.7%

2009-2010 results

6.1%

9.7%

2.4%

2010-2011 results

6.2%

9.5%

2.8%

Client services

For 2010-2011, a strategic planning year, Telefilm reached out more actively to gain a clear understanding of client satisfaction and industry needs:

- The Executive Director went from coast to coast meeting with key industry players from all regions of Canada.

- Telefilm's Strategy and Research group prepared omnibus surveys and performed industry research.

- Selected employees were consulted to supply input for program revisions and improved client services.

The findings and lessons learned from these exercises are reported in our new corporate plan Fostering Cultural Success.

A tailored approach to the industry

Telefilm delivers programs to Canada's audiovisual industry. The main programs for development, production and marketing of films are delivered through the Canada Feature Film Fund (CFFF). Telefilm also administers the Canada Media Fund (CMF) programs as defined in a services agreement with that organization.

Program decision models

Telefilm uses different decision-making models to deliver its programs. These include selective decisions and the use of mechanisms such as performance envelopes to provide more predictability and streamlined decision-making for clients with an established track record of success. Each of these approaches to decision-making and program delivery balances the needs of our clients with adequate due diligence and cost-effective, efficient administration.

Applications received and contracts signed

| |

Received |

Contracts Signed |

| Canada Feature Film Fund |

|

|

| Development |

1,000 |

409 |

| Production |

266 |

70 |

| Marketing |

103 |

81 |

| Other initiatives |

88 |

82 |

| |

1,457 |

642 |

| Canada Media Fund Program Administrator |

|

|

| Production (performance envelope) |

574 |

554 |

| Production (selective programs) |

173 |

89 |

| Development/versioning (selective programs) |

668 |

644 |

| Experimental program |

461 |

77 |

| |

1,876 |

1,364 |

| |

3,333 |

2,006 |

The table above shows the number of applications received and contracts signed. Oversubscription to some selective programs, which results in a lower acceptance rate for applications, has a financial impact on the administrative resources of the organization. The financial impact of high demand is an ongoing concern for CFFF since only 44% of applications received went to contract. Relative to last year, there was also a material increase in the number of applications received and contracts signed – in particular for CMF programs where applications received grew by 89% and contracts signed by 45%.�

Transparency and accountability

Telefilm uses operational and financial key performance indicators (KPIs) to monitor progress towards its operational goals. These indicators also allow us to address efficiency and risk issues, and help us deliver a certain level of service to our clients. The following KPIs were selected for their direct impact on service response times, for their financial impact on CFFF clients, and for administrative cost efficiency dealing with public funds.

| Operational indicators |

Targets

|

Results |

| |

2008-2009 |

2009-2010 |

2010-2011 |

Response times

for production

funding decisions

• CFFF: Decision issued |

Decision

date planned |

Target

not met |

Target met |

Target met |

| 10 weeks |

Target

not met |

Target

not met |

Target

almost met |

CMFPA service levels:

• Response time

indicators |

Targets

to meet |

Most targets met |

Most targets

met |

Some targets

met |

| Project payment triggered |

≤ 3 days |

Target met |

Target met |

Target met |

| Supplier payment triggered |

≤ 20 days |

Target met |

Target met |

Target met |

| Critical IT system hours available |

≥ 97.5% |

Target met |

Target met |

Target met |

| Critical IT systems incident-free days |

≥ 90% |

Target met |

Target met |

Target met |

CFFF production funding decision

The standards set by Telefilm's service charter are ambitious, but we are committed to meeting them. Significant process improvements are planned for next fiscal.

CMFPA service levels

The introduction of new programs, including selective programs such as the Experimental stream, as well as the Convergent stream caused a significant increase in the number of applications received and contracts signed. This resulted in only some of the CMFPA service levels being met. Process improvements are being evaluated in collaboration with the CMF in order to meet the service levels.

| Financial

indicators ($M) |

Targets

|

Results |

| 2010-2011 |

2008-2009 |

2009-2010 |

2010-2011 |

CFFF assistance

expenses |

$85.7M |

Target met |

Target met |

$96.5M

Target met |

Administrative budget:

Maximum threshold |

$28.7M |

Target met |

Target met |

$27.1M

Target met |

Financial indicators expose Telefilm's two most important risks from an administrative perspective: lapsing funds for CFFF, and overspending the administrative budget.

CFFF is on track

The CFFF target establishes the lowest level of program expenditures required in order to avoid lapsing funds, taking into account all budgetary transfers. The CFFF target was met as in previous years. Overspending was funded with recoveries.

Efficiency in administrative budget utilization

The administrative budget target represents the maximum financial resources available for utilization (calculated on a cash modified basis and before budget transfer). This budget cannot be compared to the operating and administrative expenses in the financial statements since it is accounted for on an accrual basis.

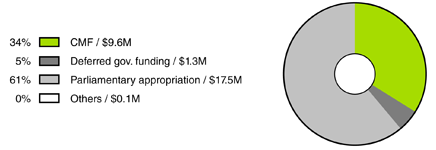

Once again target was met and for a third year in a row a portion of the administrative budget was transferred to industry programs. From Telefilm's annual parliamentary appropriation for administration, $1.5M was transferred to CFFF programs benefiting the industry. In addition, $1M of administrative expenses for fiscal 2011-2012 were prepaid through the 2010-2011 budget, leaving Telefilm in a very good position. In short, Telefilm manages public funds carefully and effectively.

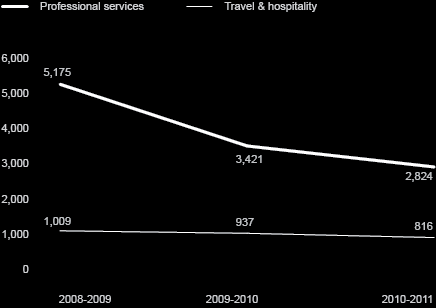

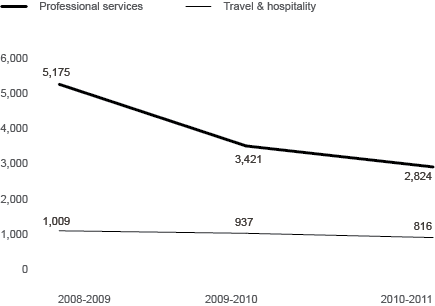

Cost containment measures

Telefilm met both the spirit and the intent of the Treasury Board Secretariat's cost containment measures by performing a thorough review of its discretionary spending.

- Professional services expenses (-45%) and travel & hospitality expenses

(-19%) decreased consistently over the last two years.

- Given Telefilm's mandate, advertising and publications expenses have not been targeted for cutbacks.

Level of expenses ('000)

Return to top

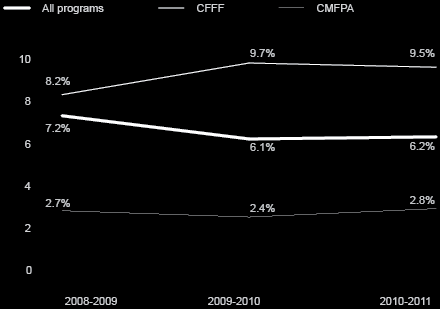

Efficient administrator

Management expenses ratio (MER)

Telefilm uses the management expense ratio (MER) and other metrics as part of its efficiency assessment for program delivery. It measures, as a percentage, the financial resources expended to deliver each program based on its annual expenses. Measurement requires a specific calculation taking into account operating and administrative expenses (net of amortization) and relevant program expenses. The ratio calculation has limitations and should not be used to compare different programs because of differences in program decision-making models.

All programs

This ratio measures all of Telefilm's operating and administrative expenses against total assistance expenses, including CMF funding programs that are not part of Telefilm's financial statements. The launch of the new CMF programs resulted in a small increase of less than 2% over last year, stabilizing the MER at 6.2%. Telefilm does not expect a major variation for this ratio next fiscal.

Canada Feature Film Fund (CFFF)

MER declined 2% from last fiscal reaching 9.5%, despite the fact that CFFF assistance expenses decreased by almost $3M and negatively affected the ratio calculation. Presentation of CFFF expenses are expected to be different for next year, so Telefilm is evaluating CFFF's MER in relation to the new disclosure.

Canada Media Fund Program Administrator (CMFPA)

This MER has fluctuated over three years between 2.4% and 2.8% in 2010-2011. Such stability over time demonstrates sound control over costs. This year, the MER increase is due primarily to costs relating to the administration of the new programs. No significant change is expected in CMFPA's MER next fiscal.